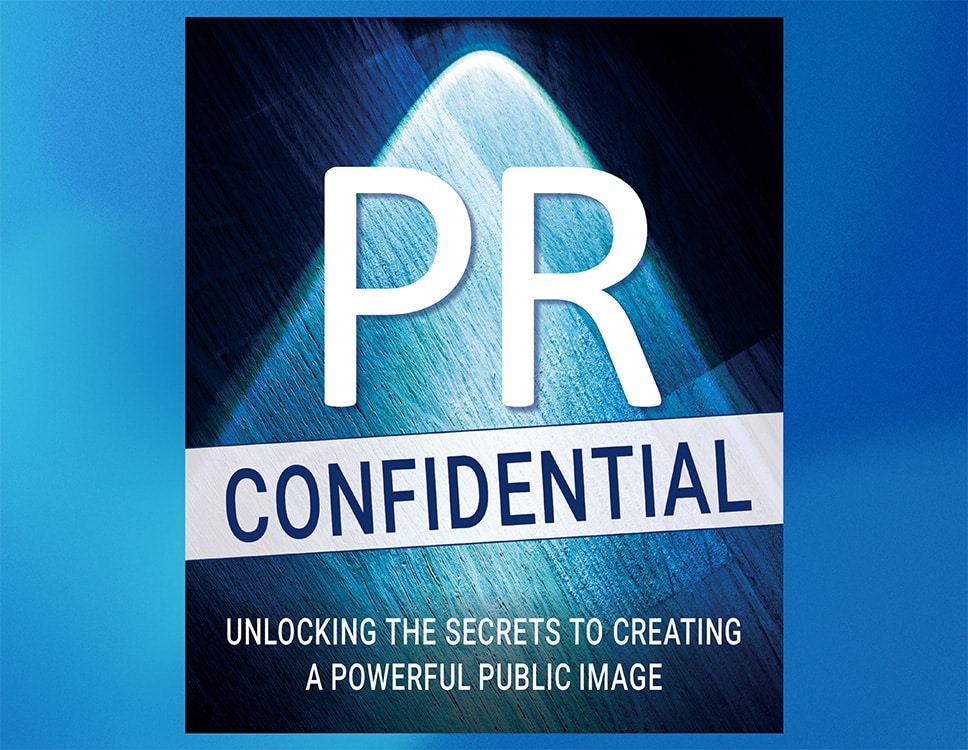

Lightspeed PR/M Wrote a Book!

PR Confidential: Unlocking the Secrets to Creating a Powerful Public Image is NOW AVAILABLE

Our new book by Lightspeed PR/M co-founder Amanda Proscia is a best-seller on Amazon but you can download it for free right here. Get ready to be entertained as Amanda shares stories, insights, and insider knowledge about how PR works, when it fails, and how to course-correct as the story changes. Whether you’re a PR newbie or a seasoned pro, you’ll enjoy this refreshingly honest guide to public relations. Better yet, you’ll emerge with a better understanding of how to put PR to work for your business.

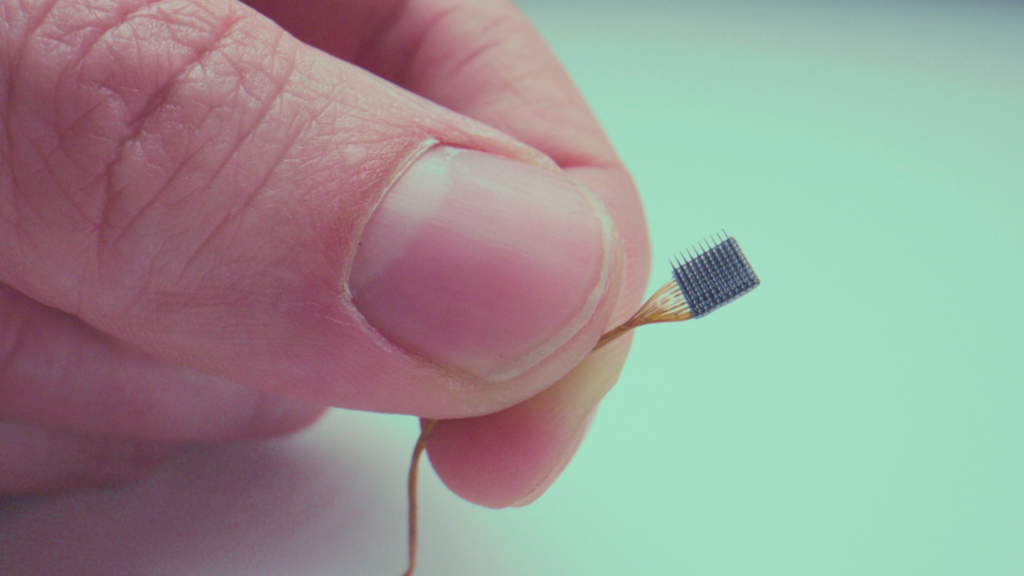

DownloadAward-Winning Work

Does your company message lead people to take action?

We help you stand out by developing messages that will work hard for you, telling your story in a way that matters. Whether it’s a product launch, reputation campaign, brand rebuilding or thought leadership, Lightspeed PR/M has the relationships and expertise to motivate reporters, producers and influencers to make your story the one that leads.

Do you have trouble making your messages understood?

We get it – your brilliant concept is often difficult to explain in a way that’s clear and simple to all audiences. That’s how we work with you: to help define your story, then share it in a way that will be most impactful for your business – in plain English, without jargon – while resonating as something that’s important.

You’ll never experience the “pitch and switch” at Lightspeed.

The team you meet at the start is the team that will be your day-to-day leaders. That’s one of the ways we’re different from other agencies, we know you’ll be most successful by working with experts, leveraging their decades of experience and relationships to help you win at Lightspeed.

Find out more

Do you know how your PR agency is working for you?

Our clients do. Because we believe even the best results can be better. That’s why we’re constantly tracking and reporting. Our clients always have in-the-minute updates of our work, with results that can be tracked, improved upon, and used for even greater impact.

Find out more